C6 Capital

About Us

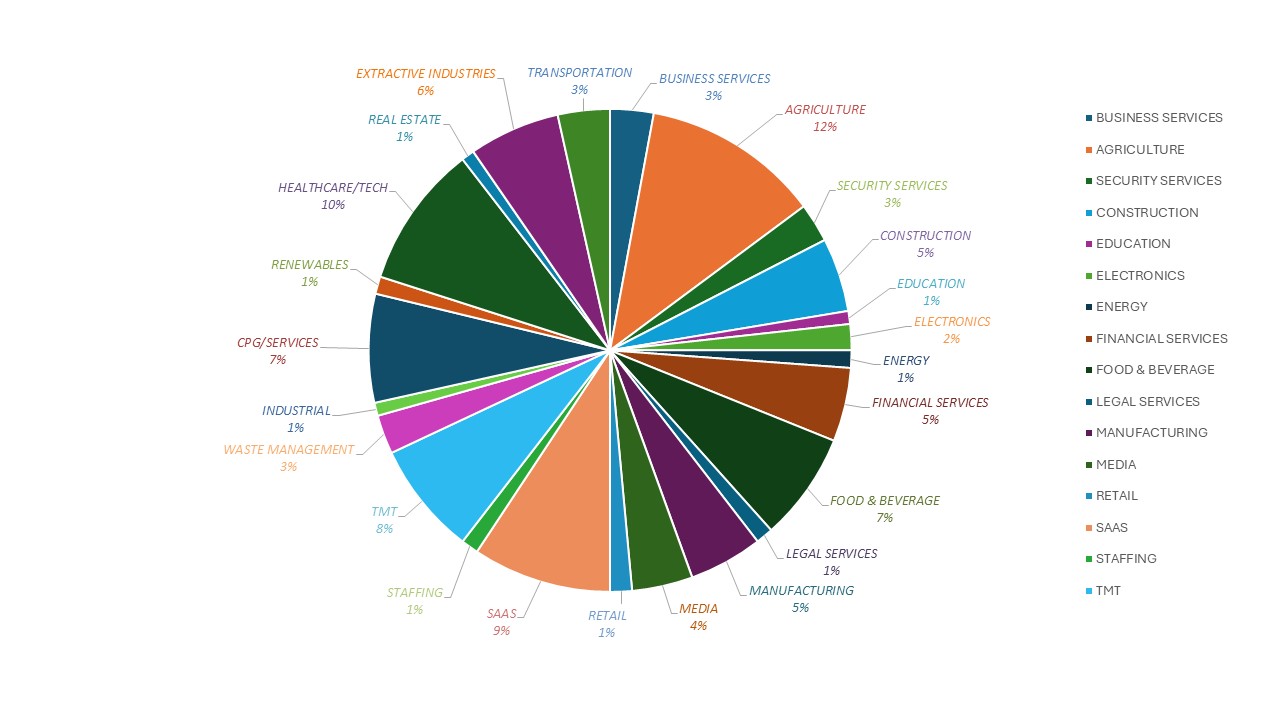

C6 Capital is a family business founded by a father-son duo, valuing operational speed and flexibility, understanding unique financing needs. Since 2018, we've funded over 300 businesses, totaling $400+ million. We invest in established companies led by experienced management.

C6's mission is to help companies close on events that will grow EV without dilution. We understand that traditional financing channels might not align with your business's timeline, C6 Capital excels in speed and flexibility, making them our core strengths.